Development of an E-commerce Site

with Smartcard Payment Mechanism

Christopher S. Lacey

MEng Electronic Systems Engineering

with Management Studies

Supervisor: Mr. P J Miller

Electronic Engineering

School of Engineering and Applied Science

Aston University

Submitted: May 2001

© Chris Lacey / Aston University, 2000 - 2001.

To contact the author, see www.cslacey.co.uk/project

The author wishes to express his gratitude to the following:

Mr. P J Miller and Dr. J A R Williams of the School of Engineering and Applied Science, Aston University, for providing ongoing advice and assistance for the duration of the project.

Mr. J Ward and Mr. P Trevis also of the School of Engineering and Applied Science, Aston University, for providing technical support.

Hitachi Smart Commerce division for the donation of smartcard equipment and development software; specifically, Mr. J Griffiths for providing technical support and to Mr. R Evans for arranging sponsorship.

Mr. M Meyerstein of BT Cellnet for providing information and source code with respect to Mondex value transfer.

Acknowledgements *

Contents *

Table of Figures *

1 Synopsis *

2 Introduction *

2.1 Context *

2.1.1 Applicability of Smartcard Technology *

2.2 Requirements *

2.2.1 Electronic Cash *

2.2.2 Personal Profile *

2.2.3 E-Commerce Web Site *

2.3 Overview of Report *

3 Server-Side Design Issues *

3.1 Choice of Web Server *

3.2 Server-Side Processing *

3.3 Maintaining State *

3.4 Database *

3.4.1 Database Transactions *

3.5 Encrypted Communication *

3.5.1 Public and Private Keys (Asymmetric Cryptography) *

3.5.2 Digital Certificates *

3.5.3 SSL and Certificate Authentication *

4 Server Implementation *

4.1 ASP Syntax *

4.1.1 Code Convention *

4.2 Separation of Code and Presentation *

4.2.1 The need for inline code embedding *

4.2.2 Function Libraries *

4.2.3 User Redirects *

4.3 Database Structure *

4.3.1 Relationships *

4.3.2 Tables *

4.3.3 Queries *

4.4 Server-Side Java Application *

4.5 SSL *

5 Client-Side Design Issues *

5.1 Hypertext Markup Language (HTML) *

5.1.1 Frames *

5.1.2 Forms *

5.1.3 Client-side Scripting *

5.1.4 Dynamic HTML *

5.2 Cascading Style Sheets (CSS) *

5.3 Client-Side Java Applet *

6 Client Implementation *

6.1 Web User Interface *

6.1.1 SmartCentre Site *

6.1.2 Aston SmartMarket Site *

6.2 Client-Side Java Applet *

6.2.1 Interface Methods *

6.2.2 Netscape Navigator and Internet Explorer Security Models *

6.2.3 Drivers for Smartcard Readers *

7 Smartcard Design Issues *

7.1 Choice of Operating System *

7.2 Card-Client Communication *

7.2.1 Command APDU’s *

7.2.2 Response APDU’s *

7.2.3 APDU Cases *

8 Smartcard Implementation *

8.1 Feature Set *

8.1.1 PIN Requests *

8.2 Developmental Process *

9 Cryptographic Challenge and Response Cycle *

9.1 Requirements *

9.2 Implemented Solution *

9.3 Debit Procedure *

9.4 Credit Procedure *

9.5 Tolerance to Network Failures *

9.6 Tolerance to System Interruptions *

9.7 Security *

10 Evaluation *

10.1 Project Costing *

10.1 Possible Future Development *

11 Conclusion *

References *

Bibliography *

Appendix 1: System Overview *

Appendix 2: Public Explanatory Material *

Appendix 2.1: Introduction to SmartID and SmartWallet *

Appendix 2.2: Privacy Statement for SmartMarket *

Appendix 3: Server Installation Instructions *

Appendix 3.1: Implementing SSL *

Appendix 3.1.1 Generation of Server Certificate *

Appendix 3.1.2: Enabling SSL *

Appendix 4: Client Installation Instructions *

Appendix 4.1: Drivers for Smartcard Reader *

Appendix 4.2: Internet Explorer *

Appendix 4.3: Netscape Navigator *

Appendix 5: Server Code *

Appendix 5.1: ASP Examples *

Appendix 5.1.1: Library for calling cryptographic functions (sw_lib.asp) *

Appendix 5.1.2: Server-side validation for registering a user (adduser.asp) *

Appendix 5.1.3: Validating card’s debit response (scauthorise.asp) *

Appendix 5.2: Server-Side Java Application *

Appendix 6: Client Code *

Appendix 6.1: HTML and ECMAScript Examples *

Appendix 6.1.1: Using client-side Java applet with forms (configsid.html) *

Appendix 6.1.2: Client-side validation of forms (setpin.html) *

Appendix 6.2: CSS Example (aston.css) *

Appendix 6.3: Client-Side Java Applet *

Appendix 6.3.1: SmartID class *

Appendix 6.3.2: MessageFrame class *

Appendix 6.3.3: PinRequest Class *

Appendix 7: Smartcard Code *

Figure 4.1: Pseudocode indicating use of inline scripting *

Figure 4.2: ASP code showing use of function libraries and server-side includes *

Figure 4.3: Extract from db_lib database access library *

Figure 4.4: Extract from adduser.asp showing use of user redirects *

Figure 4.5: Database structure *

Figure 4.6: ASP code to call ‘preemptResponse’ method in Java application *

Figure 5.1: Main frame structure *

Figure 5.2: Browse/search products frame structure *

Figure 6.1: Form used to configure personal profile *

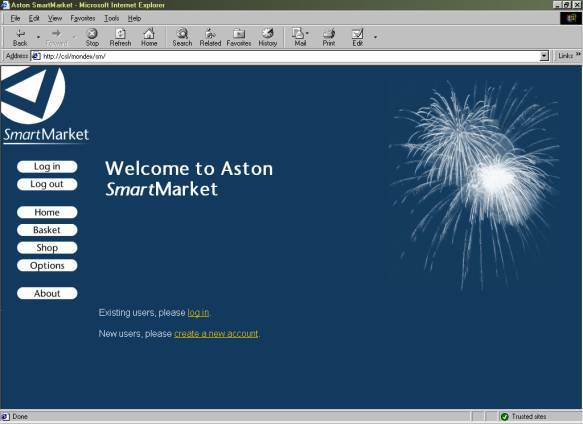

Figure 6.2: Aston SmartMarket front page *

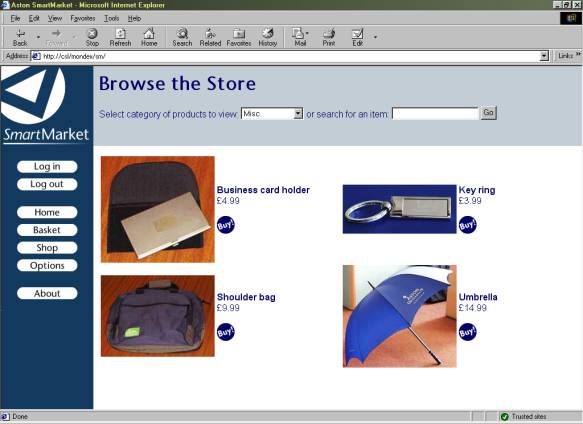

Figure 6.3: Pages to search product database and view results *

Figure 7.1: ISO 7816-4 Command APDU structure *

Figure 7.2: ISO 7816-4 Response APDU structure *

Figure 8.1: Implemented smartcard feature set *

Figure 9.1: Debit communication sequence *

Figure 9.2: Credit communication sequence *

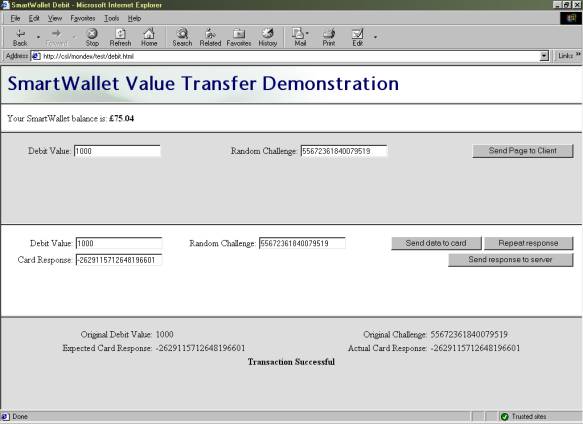

Figure 9.3: Debit test site *

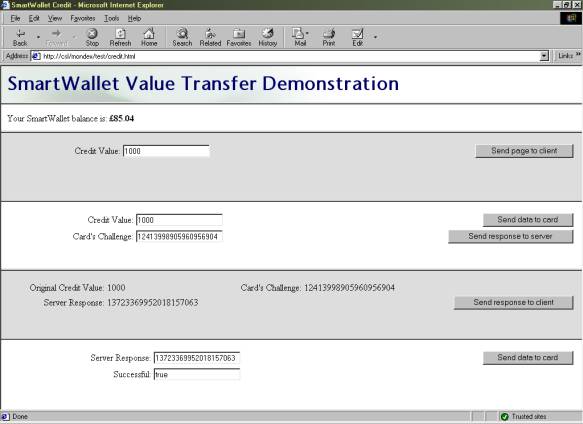

Figure 9.4: Credit test site *

In an attempt to provide a solution to the problem of using credit cards for payment over the Internet, the objective of this project was to implement a fully functioning E-commerce site which utilised a smartcard mechanism for payment..

Due to the fact that the creators of existing smartcard wallets appear reluctant to divulge their full specifications, a smartcard-based electronic cash system has been developed from scratch, providing means for instantaneous, anonymous transfer of value across an insecure network, such as the Internet. Analysis and test of the system have suggested the implementation to be secure.

Additionally, smartcard technology has been employed to solve another perceived problem with business-to-consumer E-commerce sites: that of the need for repetitive personal data entry. A profile system has been created which permits storage of personal data in one location (the smartcard), and rapid completion of HTML forms by automatic retrieval of this information.

An E-commerce site has been created with which these two systems have been successfully integrated, indicating that smartcard technology does provide a feasible means for addressing the problems identified. However, complications identified at the client side suggest that widespread adoption of the technology will not occur until suitable standards are developed and adhered to.

The explosive growth of the Internet has caused a revolution in the manner in which businesses and consumers conduct commercial exchanges. E-Commerce is currently a major growth industry, and the number of transactions carried out online is escalating exponentially.

The advantages provided by Internet commerce are self-evident, and explain the enthusiasm shared by companies and customers for trading in this manner. For the supplier, there is greater potential to compete on a global scale, and cost savings can be attained in terms of staff and real estate by removing the need for public-facing premises. For the consumer, a means is provided to browse and search for products, and compare the prices of different suppliers, more quickly and easily than was previously possible.

However, some problems have arisen with respect to business-to-consumer ("B2C") systems, which to this day have prevented them from realising their full potential.

Firstly, there is a general reluctance amongst the public to transfer their credit or debit card number across the Internet, for fear of it being intercepted and unlawfully misused. The use of encrypted communication (via SSL) has gone a long way to alleviate this fear, but it does still remain an issue: a significant number of potential purchases are lost for this reason.

Secondly, credit and debit cards are not ideally suited to purchasing many of the products or services that are available, or could be made so. In many situations, a system more resembling cash would be preferential - avoiding delays inherent within credit card clearing systems, permitting micropayments (e.g. of a few pence) to be made for online services, retaining customer anonymity and providing a means for the user to be aware of his current balance at all times.

Finally, the tedious activity of repetitively entering personal information, such as shipping address, for every transaction or site registration is disconcerting to many users. A research study conducted by Jupiter Communications (NY) in 1999 indicated that more than a quarter of users surveyed had abandoned a transaction solely due to the length or complexity of the form which had to be completed.

Various solutions to these problems have been proposed, such as SET and Web ‘Beanz’ for payments; and ‘Autocomplete’ and Microsoft Profile Assistant for completing forms. However, each of these systems solves only one of the problems mentioned: SET, for example, avoids the need for transmission of credit card information, but still uses such a card as the ultimate means for payment. In addition, most solutions tend to be tied to a user’s own computer, preventing them from being used effectively in Internet cafés or on other machines.

2.1.1 Applicability of Smartcard Technology

Smartcards have two fundamental capabilities - that of data storage and processing power. In terms of the former, they provide advantages in terms of their portability and - more uniquely - the fact that the data stored upon them can be made tamper-proof. Physical security of the cards provides good protection against attempts to read or modify the contents of memory by external means. Data can therefore only be accessed via the interface defined by the program resident on the card, meaning that a system could be created whereby information is not released from the card unless a correct PIN is entered beforehand, for example.

The processing power of the card is of particular use for cryptographic and other sensitive operations, where - for example - digital signatures can be generated and validated without a user’s private key ever leaving the card.

Smartcards’ tamper-proof data storage, and their capability to perform cryptographic operations, therefore appeared to provide a feasible means for addressing the problems previously described: firstly, by allowing user profile information to be stored and quickly transferred by insertion of the card into a smartcard reader; secondly, by providing a secure means for value to be stored and transferred by means of a trusted applet resident on the card.

The aim of this project was to design and create a fully operational E-commerce site which would make use of smartcard technology in order to attempt to provide a solution to the problems previously discussed. Users would therefore be required to have a suitable smartcard reader attached to their computer in order to make use of this.

In order to represent "real" cash most accurately, there is a requirement for (i) value to be stored on the smartcard only, and not recorded elsewhere (thus maintaining anonymity).

Clearly, therefore, a card applet needs to be created which will (ii) prevent users from defrauding the system by increasing their balance without authorisation from the card issuer; and (iii) prevent debits from being made without the user’s consent.

Finally, there needs to be a means for (iv) securely transferring value between the card and a remote host, over an insecure network which is open to eavesdropping and modification of the data being transferred.

It was initially the intention to use Mondex, a proven smartcard-based electronic cash product, as the basis for value transfer within this project. However, Mondex International, creators of the system, were unwilling to provide the protocol specifications required for security reasons. Consequently, a suitable electronic cash system had to be developed from scratch.

The basic requirement was for the smartcard to (i) store textual information within a number of profile "fields" and for a means to be provided for (ii) a web site to retrieve this data.

Additionally, provision had to be made for a user to (iii) update his profile information whenever necessary, and to (iv) specify preferences as to whether, and how often, a PIN should be requested before sensitive information is released.

The objective to develop a personal profile was not part of the original project specification. It was taken on at the request of Hitachi, providers of smartcard readers and development software for the project.

The core functions provided by any E-commerce site are to (i) allow users to browse or search within a database of items or services, (ii) select those required for purchase and place into a virtual "shopping basket", and (iii) "check out" by authorising value transfer to the vendor.

Additionally, for this project, it was necessary to (iv) utilise the electronic cash and personal profile systems previously described.

Three fundamental components to the overall system clearly emerge, namely Server, Client and Smartcard. The following chapters deal with these individually: for each, a Design Issues chapter describes and justifies the major conceptual decisions made, and an Implementation chapter outlines key methods by which the design was realised.

The method by which value transfer was achieved is described separately in 9 Cryptographic Challenge and Response Cycle, as it involves the server, client and smartcard equally, and cannot be satisfactorily described for each component in isolation.

The success of the project is then evaluated, and possibilities for future development identified. Finally, conclusions are drawn from the findings made.

Different permutations of operating system and web server software were assessed, and in many cases evaluated through installation, test, and review of their accompanying documentation.

UNIX servers tend to be highly regarded for their reliability and stability, hence initially appeared to be an attractive option for deployment. However, at the time when this assessment of alternatives was being conducted, Mondex was intended to be the means by which payments would be made within the site, and it was therefore assumed that a smartcard reader would be needed on the server in order to facilitate card-to-card value transfers. The majority of such devices are supplied only with Windows drivers - UNIX alternatives are generally slow to materialise and are usually unsupported - and as such the decision was made to select Windows NT Server as the platform upon which the web server should run.

The Apache HTTP Server and Microsoft’s Internet Information Server (IIS) were then critically compared, the latter finally being selected due to the fact that its native scripting language (ASP) was unique in providing support for instantiation of Windows COM objects, thus permitting communication with the smartcard reader via vendor-supplied components. Various modules providing ASP support for Apache were located and tested, but these were found to possess incomplete feature sets - none of them providing COM support.

An E-commerce site obviously requires some degree of server-side processing over and above simply relaying static content at the request of browsers - for example, supplying pages which show products that match a user’s search criteria. The decision was made to utilise IIS’s inline scripting capabilities to perform the majority of server-side processing, as this technique uses the application’s memory space to process the scripts, draining fewer resources than using CGI, with which a new process needs to be created to serve every separate page request.

IIS is capable of supporting a number of different scripting languages (VBScript and JScript as standard, Perl and other alternatives by deployment of appropriate modules). No one language appeared to offer any particular advantage, hence VBScript was chosen solely because this appears to be the most common choice amongst users of ASP, and thus more documentation and support is available for it.

The protocol via which web pages are requested and served (HTTP) is stateless, in that each page request is effectively an isolated event whereby a connection is maintained between client and server for the transmission of a single file only. Navigating to a particular page by entering its URL into the address bar of a browser or by selecting a hyperlink causes a TCP connection to be made to port 80 of the appropriate host, followed by an instruction of the form:

GET /filename.html HTTP/1.0

Assuming the file requested is available, the web server then responds by transmitting the page back to the client, and the connection between the two machines is immediately released.

The stateless nature of HTTP demands that consideration be given to how some form of persistence be created within the system. Clearly, for an E-commerce site, it is desirable for a user to move between several pages, browsing and searching for items, and adding those which are required to a virtual "shopping basket". It is obviously necessary for the selections made to be retained for at least the duration of the user’s visit to the site, and preferably also between successive visits.

Various extensions to HTTP, which are now mature and supported by the vast majority of browsers, provide means to overcome this problem. The most established method is known as HTTP Authentication, whereby the web server inserts the following headers into its initial response to a page request:

WWW-Authenticate: Basic

HTTP/1.0 401 Unauthorized

Browsers supporting HTTP authentication will then prompt the user for a username and password, cache this information, and retransmit it within the headers of every subsequent page request to that site. Consequently, by observing the username and password accompanying each page request, the server can ascertain which user is being served and modify the contents of the information returned accordingly.

An alternative to this technique is to use cookies, which are small text files created by the browser on the user’s system upon the request of the server. The information to be stored within these files is sent to the client within the response HTTP headers, and this is then retransmitted by the browser within the headers of every subsequent page request to the same site. Consequently, by using cookies to store a unique identifier for a particular user, page responses can be personalised by the server accordingly.

When cookies first came into existence (in Netscape Navigator 2.0), they were viewed with suspicion by some users who regarded the act of text files being saved on their own machines as a security threat. The fact that these files contain textual data which is managed by the browser, only ever sent to the site which originally created it, and never executed, has caused this attitude to be no longer widely held, and although users can still choose to reject them, all browsers in common use today silently accept cookies by default. In addition, creation of the concept of "session cookies" which exist in the browser process’s volatile memory, and thus remain in existence only until the program is closed, have served to provide a technique for providing persistence to which few are opposed.

In general, cookies are used much more widely than HTTP Authentication, and as such the appearance of the browser’s login box is now rarely witnessed and can be disconcerting for inexperienced users. In addition, because the manner in which the username and password are requested is unique to each individual browser, it would not be possible to provide a consistent mechanism for logging in using a smartcard should this method be employed for user identification. Consequently, despite the small possibility of user rejection, it was decided that the less controversial "session cookie" be used to provide login facilities to the site, together with an explanation of the security issues involved.

Additionally, it was decided to provide the option for creating a permanent cookie to provide automatic login to the site.

There was a clear need for the existence of a database on the server, which would contain information relating to the products or services available for sale on the site (e.g. description, price and stock information).

In addition, it was believed to be desirable for the database to be the location in which the contents of users’ "shopping baskets" was held. It would be possible for the session cookie created on the client’s machine to retain this information; however, because cookie data is transmitted with every page request, use of a server-side database minimises the amount of data being transferred, and thus the speed of response. Additionally, it permits the contents of baskets to be remembered indefinitely (i.e. between visits).

A large number of different database products are available, all with their own particular advantages and disadvantages. Assessment of which was the most suitable for an E-commerce site would be dependent upon factors such as the expected server load, and a detailed evaluation of alternatives was not considered to be within the scope or budget of this project. Use of a standard query language and abstraction layer to connect to the database (specifically, SQL via an ODBC connection) was therefore deemed essential, so that the underlying engine could be replaced should it become necessary (easing migration to a heavy-duty Oracle database should server load escalate, for example).

Certain operations that may need to be carried out on the database are comprised of a number of separate actions - such as the process of checking out, where each product purchased must be deleted from the user’s basket and a corresponding record made elsewhere to authorise dispatch.

It is important to ensure that, in the event of an error or problem occurring on the server, the entire operation would fail or succeed as a single unit (i.e. either all of the component actions would be completed, or none of them). Such an operation is said to be atomic.

In order to achieve this requirement, it was decided to use transactional features within the database whereby a transaction is commenced immediately before the first critical operation and committed following the final one. Should any step in the transaction fail, all other steps are automatically rolled back, thus preserving consistency of the data.

The database engine also ensures that partial results of incomplete operations are never obtained by other concurrent processes (e.g. other ASP page requests) by locking the relevant fields for the duration of the transaction. Due to the fact that transactions only appear to be required for records and fields specific to individual users, no problems should occur with the database being made unavailable to other users of the site.

Communication via the Internet is inherently insecure, as data transferred over it is open to eavesdropping at many different points. Consequently, there is a need for any system which involves the transmission of sensitive information (such as credit card numbers) to provide means for encrypting communication between server and client and to assure users of the true identity of the site with which they are dealing, hence the rationale behind deploying SSL.

3.5.1 Public and Private Keys (Asymmetric Cryptography)

When used for encryption, public and private keys are analogous to padlocks and their keys, whereby information can be encrypted using a public key (locked with a padlock) such that it can only be decrypted using its associated private key (unlocked with its key).

Consequently, public keys can be widely distributed to enable anyone to encrypt information in the knowledge that it can only be decrypted by the holder of the associated private key.

Additionally, however, data encrypted using the private key can be decrypted by anyone in possession of the associated public key. If meaningful information can be extracted using the public key, one can be certain that only the holder of the private key could have encrypted it initially (i.e. the origin of the data is assured). This technique forms the basis for digital signature systems.

In order for asymmetric cryptography to be used effectively, it is necessary for the holder of a public key to be certain that the key is in fact associated with the private key owned by the intended recipient. Using techniques such as IP spoofing, it might be possible to masquerade under the identity of another user or server and supply a different public key which would allow unauthorised access to information encrypted with it.

In order for the true owner of a public key to be determined, Certification Authorities (CA’s) such as Verisign and Thawte have been established to act as trusted third parties which will verify the identity of a person or organisation before providing them with a digital certificate. Such certificates are wrappers containing textual information concerning the owner’s identity, together with the actual public key. The wrapper itself is signed using the CA’s private key which gives anyone proof of its authenticity. The CAs’ public keys, required to verify certificates as being valid, are supplied as standard within all common web browsers and web server software.

3.5.3 SSL and Certificate Authentication

SSL is a standard technique used for secure data exchange on the Internet and on private networks. Typically, a web server will present a browser with its digital certificate which will act as proof of its identity, and contain its public key using which data sent to it can be encoded.

As Internet Information Server and the majority of mainstream browsers support SSL, the decision was made to apply for a suitable digital certificate from a known CA, and to make use of SSL for the transmission of address and credit card information to the server.

Please refer to the accompanying CD-ROM to view the commented code and other files created to implement the system (‘Web’ directory for ASP code, ‘Server’ directory for Access database and Java application source).

A description of ASP syntax and usage is not within the scope of this document. However, the reader may benefit from knowing that directives are distinguished from standard HTML code by being surrounded by <% and %> delimiters. In addition, the <!--# .. --> tag is used for specifying for server-side includes.

Within this section, highlighted text will be used to distinguish server-side instructions from HTML code, where necessary. Comments within code will be shown in green.

4.2 Separation of Code and Presentation

ASP inline scripting (where pre-processor instructions are embedded amongst standard HTML tags) is not well suited to separating code from presentation information. However, where possible, user redirects and function libraries were utilised to isolate significant code blocks to "dedicated" script files.

4.2.1 The need for inline code embedding

In some situations, it was however essential to embed code in the middle of an HTML page, as in the case of a product listing - illustrated by the following pseudocode:

Page header HTML: Title, Table header, etc.

FOR EACH Product that matches selection criteria

New table row

New table cell

Print Product name

New table cell

Print Product price

NEXT Product

Page footer

Figure 4.1: Pseudocode indicating use of inline scripting

In order to minimise the code content of pages, and to reduce coding repetition, a number of libraries were created containing related functions (e.g. those pertaining to database access). These were included, when required, by use of server-side includes, as shown in the following example:

<% @LANGUAGE = VBScript %>

<!--#include file="../std_lib.asp"-->

<!--#include file="../db_lib.asp"-->

<html>

<head>

<link rel="stylesheet" href="main.css">

</head>

<body>

<p>Current order total: <strong><%=getBasketTotal()%></strong></p>

etc...

Figure 4.2: ASP code showing use of function libraries and server-side includes

ASP does not support the concept of "libraries" as such; the #include directive simply causes the contents of the referenced document to be placed at that point within the file. Consequently, care had to be taken to avoid duplication of variable and function names across multiple libraries, as should more than one ever be included in a document, confusion would result. Suitably descriptive names were therefore used for functions and "global" variables that might need to be referenced externally; and "local" variables were prefixed with a common identifier (e.g. db_ for database variables), as shown in the example below:

<%

Dim objConn, db_strConn, db_strQuery, objRS

Set objConn = Server.CreateObject("ADODB.Connection")

db_strConn = "DSN=SmartMarket;Database=SmartMarket;UID=sa;PWD=;"

objConn.Open(db_strConn)

Function isEmptyRS(db_strQuery)

Dim db_checkRS

Set db_checkRS = objConn.Execute(db_strQuery)

isEmptyRS = db_checkRS.EOF

db_checkRS.Close

End Function

etc...

Figure 4.3: Extract from db_lib database access library

In many cases, the submission of a form to the server requires a considerable amount of processing to be carried out before a simple page is returned indicating success or failure. As opposed to embedding HTML representing the user message within large amounts of ASP code, these messages were created in separate pages, and HTTP redirect responses sent to the client, causing it to request the appropriate "success" or "failure" page after processing of the form was complete. For example, the following script is an extract from the ASP script called on submission of the "Add new user" form:

'Check to see if user already exists in database

Figure 4.4: Extract from adduser.asp showing use of user redirects

In this case, if the two passwords entered by the user do not match, he is forwarded to "adduser_diffpass.asp"; if any essential fields are left blank, he is forwarded to "adduser_incomplete.asp", and so on.

A Microsoft Access database was used for storing user and product information; this product being chosen solely for its ease of availability (see 3.4 Database Design Issues).

Being a relational database, it is possible to define relationships that exist between fields in different tables. Such usage enforces referential integrity - by defining the structure at such a low level, faulty code or interfaces are prevented from entering invalid data into the database, allowing problems to be recognised more easily and thus assisting in debugging.

The tables created, and relationships between fields are as shown below. Primary keys are indicated in bold.

Figure 4.5: Database structure

The Accounts table contains a record for each registered user, comprising username and password, real name, and the shipping address most recently entered (i.e. for the current transaction). Products contains the full list of items available, each being assigned a category from the list defined in Categories. These categories are used within the browsing process - the user being able to view all relevant products by selecting the required category from a dynamically created drop-down list within his web browser.

Baskets brings together user and product information (from Accounts and Products, respectively) to indicate the items selected by users to be in their "shopping baskets". Within Access, the relationships defined between fields can only be of the type One-to-Many, as shown (e.g. a product may only be assigned to one category, but a category may be assigned to many products). In order to provide a Many-to-Many relationship for the shopping baskets (a user may select many products, and a product may be selected by many users), Baskets is required to act as a junction table, possessing two primary keys to ensure uniqueness only of the combinations of (ProductID,Username) tuples (i.e. it is possible for multiple records to exist with the same ProductID, providing the Username differs for each such record; and vice-versa).

Once a purchase is made, products (referenced by ProductID) are "moved" to the Dispatches table, which would be used by the shipping department to arrange for despatch. Each record relates to one product only, to allow individual components of an order to be considered separately. Hence, whenever sufficient stock was available, a delivery could be made, and the record deleted from the system. The Name and Address fields relate to the shipping details entered during the checkout stage, and are not stored elsewhere in the system to ensure no permanent record is made of them, for user privacy reasons.

CardPayments represents the list of credit card transactions that have been processed. In the case of this system, a credit card transaction is deemed to have been successfully carried out once an entry for it is made into this table. Obviously, in a real E-commerce site, transaction authorisation would be made by a bank or clearing house - entry of data into this table, however, simulates this process.

BasketQuery and BasketSubtotals are queries created within the database. Effectively, these are read-only tables which are dynamically created by the server.

BasketQuery defines a link between its ProductID field and that of Products and thus provides the data required for the server script to display details of a user’s basket (without need for it to perform its own cross-referencing to obtain product description, for example).

BasketSubtotals links its Username field to that of BasketQuery, and calculates the total cost of products within each user’s basket by defining the Subtotal field to be an expression of the form:

Subtotal: Sum([BasketQuery]![Quantity]*[BasketQuery]![Price])

i.e. the summation of (quantity x price) for each item in BasketQuery associated with a particular username.

4.4 Server-Side Java Application

VBScript’s "long" integer type was found to use a 32-bit signed number representation, hence was capable of representing numbers with maximum magnitude of 232. This was insufficient for performing calculations with 64-bit numbers, as used for the challenges and responses within the smartcard debit and credit procedures (see 9 Cryptographic Challenge and Response Cycle).

Consequently, a Java application was created which provided methods for performing the calculations, accepting arguments and returning values as strings, and utilising the java.math.BigInteger class which provides for representation of arbitrary length numbers.

Recent versions of the Java VM for Windows allow any Java application to be instantiated as a COM component - this facility was exploited to provide a means for the ASP code to call the methods created, as illustrated below:

Dim sw_smartIDChallenge

Set sw_smartIDChallenge = Server.CreateObject("CSL.SmartIDChallenge")

Function preemptResponse(sw_value, sw_challenge)

preemptResponse=sw_smartIDChallenge.preemptResponse(sw_value,

sw_challenge, sw_privateKey)

End Function

Figure 4.6: ASP code to call ‘preemptResponse’ method in Java application

Here, ‘CSL.SmartIDChallenge’ was the identifier (CLSID) used to register the Java applet as a COM component on the server (via the JAVAREG utility).

A free "test" server certificate was obtained from the Verisign CA, and using this, SSL was successfully configured within IIS. However, due to the fact that such test certificates expire after two weeks and the difficulty of obtaining repeat issues, SSL was not deployed within the finished system. This should not be regarded as demeaning its necessity in any way - should a release system ever be created, a suitable server certificate would need to be purchased, and SSL re-enabled.

5.1 Hypertext Markup Language (HTML)

All web pages are ultimately passed to a browser’s rendering engine as HTML, this being an application of SGML. In their simplest form, HTML documents consist of a basic block of text, interspersed with control codes (‘tags’ of the form <address>..</address>) to indicate the nature or desired appearance of the "marked up" text. Tags also exist for providing hyperlinks to other pages, displaying images, embedding Java applets, providing form components to receive user input, and so on.

The language is officially managed by the W3C, who define the complete list of tags, their usage, and the manner in which user agents (i.e. web browsers) should render content. However, HTML has been in a constant evolutionary process since its inception; consequently different browsers support different versions of the language and very few have ever correctly supported the standard in its entirety. Additionally, vendors have attempted to provide enhancements via their own proprietary additions (for example, Netscape Navigator’s <blink> and Microsoft Internet Explorer’s <marquee> tags).

User agents are required to handle tags which they do not recognise by simply ignoring them, and as such, careful design permits advanced features to be implemented transparently - providing enhanced functionality to those browsers which support it, but still permitting users of less well featured browsers to view the basic information present on the page. Internet usage statistics suggest that over 85% of users view pages with a browser which supports HTML 4.0 (revised April 1998)1; consequently it was decided that this version be used as the basis for developing the site, whilst ensuring that older browsers (supporting HTML 3.22 and earlier) be capable of providing core functionality, albeit with a less refined appearance and user interface. Proprietary features have been avoided completely.

Differences in users’ system configurations (e.g. screen resolution, colour depth, font availability), and in the interpretation and implementation of the HTML standard within browsers, mean that the manner in which web pages will appear can never be completely predictable. Despite the temptation to do so, considerable effort was made to avoid designing the site for use on particular browsers and systems, instead making correct use of HTML to ensure that the site be accessible from all platforms - both those currently in existence and those only just emerging, such as "Web TV" and other embedded systems. However, due to the fact that around 95% of web site hits are made using Microsoft Internet Explorer or Netscape Navigator, the site was rigorously tested using these two browsers to ensure an intuitive and aesthetically pleasing service for the majority of customers.

"HTML frames allow authors to present documents in multiple views, which may be independent windows or subwindows. Multiple views offer designers a way to keep certain information visible, while other views are scrolled or replaced."1

The decision was made to employ frames to provide a persistent toolbar for easily navigating around the site (providing links to browse products, view shopping basket, log out, etc.), as illustrated below. Additionally, because the toolbar frame remains in existence for the duration of a visit, this was deemed the best place to embed the client-side Java applet for communicating with the smartcard.

|

Toolbar Frame - Log in - Log out - Home - Basket - Shop etc. |

Main Frame

Displays selected page |

Figure 5.1: Main frame structure

Similarly, an additional frameset within the main frame itself was considered most appropriate for enabling users to search for and browse categories of products on the site:

|

Toolbar Frame - Log in - Log out - Home - Basket - Shop etc. |

Search Frame Select category / Enter search term |

|

Products Frame Displays products matching search criteria |

Figure 5.2: Browse/search products frame structure

Each frame within a frameset displays the contents of a separate HTML page, hence a frameset document itself is fairly small - typically defining only the structure, layout and URLs of the individual frames. It is also possible, however, to provide content within <noframes>..</noframes> tags which is rendered by browsers that do not support frames. This facility was used to provide links to the most relevant page (e.g. the "welcome" page within the opening frameset); and all pages within the site were designed to provide an alternative route to each page, should the static toolbars be absent. Links were used in preference to repetition of content within the <noframes> section in order to ease maintenance of the site (updates would otherwise require changes to be made in two places), and in order to prevent unnecessary amounts of data from being transferred to the majority of users who would be using frames.

"An HTML form is a section of a document containing normal content, markup, special elements called ‘controls’ (checkboxes, radio buttons, menus, etc.), and labels on those controls. Users generally ‘complete’ a form by modifying its controls (entering text, selecting menu items, etc.), before submitting the form to an agent for processing." 1

Being the only method for obtaining feedback from a user in a web application, forms were clearly required for such actions as selecting categories of products to view, and submitting search criteria, quantities and shipping details to the server.

Each control is given a unique name, and upon submission, key-value pairs of the form (control name, control state) are passed to the server either within the headers of the HTTP request (the ‘POST’ method), or as a suffix to the URL (the ‘GET’ method) thus:

http://www.aston.ac.uk/?forename=fred&surname=bloggs

Some browsers place an upper limit upon the length of a URL, constraining the number of key-value pairs that can be transmitted using GET. Additionally, this method is clearly unsuitable for transmitting sensitive information as the URL (in its entirety) is likely to be clearly displayed within the user’s address bar, and may well be cached by the browser and/or a proxy server. For these reasons, it was decided that POST be used for the submission of almost all forms within the site. This technique also has the advantage of causing the information sent to the server to be encrypted if an SSL session is used. The only exception to this decision was for the submission of product category or search criteria to the "show products" page - in this case, only a small amount of information is ever transmitted (category name or search term), and the availability of URLs of the form:

http://www.server.com/products.asp?category=stationery

http://www.server.com/products.asp?searchterm=pens

provides an intuitive means for others to provide links to particular product pages on the site. Also, as the response obtained from a particular category or search term is likely to change infrequently (only when new products are added), it would be safe for a server or browser to cache the page returned, referenced by its extended URL.

The vast majority of browsers used today possess a scripting engine which permits client-side code to be run within the browser environment (e.g. Netscape Navigator 3.0 and later, Internet Explorer 3.0 and later, and Opera 3.0 and later). Usage of this scripting capability can provide considerable benefits to both client and server - for example, it can be used to validate forms before they are submitted to the server, preventing the user from wasting time waiting for a response when the form data is invalid, reducing network traffic and relieving server load.

However, despite the fact that scripts run in a "sandbox", a plethora of security "holes" have been discovered in the major browsers during recent years, allowing scripts to observe or modify elements of the external system to which they should not be permitted access. Whilst the vendors have typically been quick to provide patches to correct such problems, some users have lost confidence in client-side scripting and have disabled it within their browsers. Consequently, it is not possible to rely upon this technology for achieving core functionality.

As a result, the decision has been made to utilise client scripting for the non-essential task of ensuring form data is valid before submission (in addition to server-side validation), and as the only means for providing an interface between the client-side Java applet and components on the web page. Use of the smartcard is not essential for accessing and using the site, hence this, again, does not detract from core functionality.

The standard HTML scripting language in use today is ECMAScript, originally developed by Netscape (as JavaScript), and offered for standardisation in Autumn 1996. All browsers which support client-side scripting support this language, hence this was the natural choice for use within the project.

Dynamic HTML (‘DHTML’) provides an enhanced user experience by permitting client-side scripts to modify the appearance of the web page once retrieved from the server, allowing - for example - objects to be moved and hidden in response to particular events.

The method by which such dynamic activity is achieved differs markedly between browsers, however. Many do not support any form of DHTML, whilst the two most commonly used products (Netscape Navigator 4 and Internet Explorer 4/5) possess such radically different document object models that any form of dynamic user interface effectively needs to be written twice - once for each browser. Despite the publication of a standardised DOM by the W3C3, it is only with the recent release of Navigator 6 that some form of commonality between the Netscape and Microsoft products has been recognisable.

Consequently, DHTML has not been employed at all within this project - due to the author’s perception that it offers little benefit to the end user, and his reluctance to expend considerable effort over learning and supporting non-standard, proprietary implementations.

5.2 Cascading Style Sheets (CSS)

Separation of content from style is generally regarded as desirable, due to the fact that the role of providing and maintaining information (‘content’) is very different from that of designing an aesthetically pleasing and logical user interface. Historically, HTML has blurred the boundaries between the two - a page will typically contain information, perhaps sectioned using descriptive tags such as <address>, together with formatting commands such as <font size=’+3’> (to increase text size).

CSS provides a means for defining style in a separate location from the main HTML body (usually in a separate file entirely), and offers a far richer set of commands to define appearance. For database-backed sites, where the underlying data is already separately maintained within the database, CSS provides the advantage of allowing multiple pages to link to a single stylesheet, thus allowing changes to be made across the site by making just one set of modifications.

The majority of current browsers support CSS Level 14 (Internet Explorer 3.0 and later, Netscape 4.0 and later), hence it was decided that they be used throughout the site. Pages viewed on a non-supporting browser might appear less attractive, but would retain full functionality.

In order for communication with the smartcard to be effected, the need became apparent for the creation of an intermediate program which was capable of interfacing both with the web browser and also with the smartcard reader attached to the computer. Client-side scripting technology is incapable of achieving the latter directly, hence the most obvious means for achieving this was to create a Java applet that would be capable of running within the Java Virtual Machines (VM’s) present in the majority of mainstream browsers.

Old Java VM’s prevented applets from conducting operations which were considered potentially harmful, such as accessing hardware, via a process known as sandboxing. However, the security model of the Java platform 1.1 does permit such operations to be conducted under certain circumstances (typically, after seeking the user’s permission). Java 1.1 has been in existence for many years, hence is implemented in the vast majority of browsers used today.

Additionally, via use of a system created by Netscape known as LiveConnect, it has become possible for client-side scripts running in browsers to interface to Java applets embedded within the page - specifically, by use of the netscape.javascript.JSObject class in the Java code, and the ‘mayscript’ attribute in the <applet> tag within the host HTML.

It was clearly preferable for the applet to make use of an established standard to communicate with the smartcard reader, as opposed to making a direct connection via the serial/parallel port and being tied to one particular type of device. Consequently, it was decided to make use of a Java-based framework known as OCF that acts as an abstraction layer between software and hardware, and for which drivers are available for a number of devices.

Please refer to the accompanying CD-ROM to view the commented code and other files created to implement the system (‘Web’ directory for user interface (HTML, CSS and images), ‘Client’ directory for client-side Java applet source).

At the time of writing, the finished sites were available from http://ee-pc43.aston.ac.uk/laceycs/sc and http://ee-pc43.aston.ac.uk/laceycs/sm .

Two separate sites were ultimately created - one representing the card issuer (SmartCentre), and providing card personalisation and top-up facilities; the other (Aston SmartMarket) being the E-commerce site itself which makes use of the SmartID personal profile and SmartWallet electronic cash facilities.

Pages were created using a text editor - development tools such as Microsoft FrontPage and Macromedia Dreamweaver were avoided, as the code they generate was found to make use of proprietary features within mainstream browsers which can prove problematic when viewed in other environments.

Images were initially created in a vector-based drawing package, namely CorelXara 2.0, which allowed for the creation of standard styles and modification of graphics (e.g. enlargement and rotation) without loss of definition. When the design process was complete, anti-aliased images were saved in GIF for buttons and logos, which is a compressed, non-lossy, format providing a maximum palette of 256 colours. Photographic images were saved using JPEG format, which provides 24-bit colour depth, but uses a lossy compression algorithm (making it unsuitable for images containing highly defined edges, such as logos).

Separate pages were created for:

together with various informational pages, including success/failure feedback for top-up attempts.

Most of the pages used forms to obtain user input, passing the data to the card by use of the client-side Java applet. Topping up and repeating top-ups were the only pages to require server-side processing of forms (to generate the correct cryptographic response); the remaining pages work correctly if run locally in a web browser (i.e. not fetched from a server), providing users a means for configuring their cards without connecting to the network, if required.

Figure 6.1: Form used to configure personal profile

Frames were used to provide an easy-access toolbar, as seen in figure 6.1 above, which also proved to be a suitable static location for embedding the applet.

Separate pages were created for:

together with various informational pages, including success/failure feedback for actions such as creating a new user and making credit card or smartcard payments.

Again, a frameset was created to provide a static toolbar, although navigation through pages was such that operation in a non-frames environment is possible.

Figure 6.2: Aston SmartMarket front page

Figure 6.3: Pages to search product database and view results

The applet created provided the following methods which can be accessed from client-side scripts, thus allowing others to implement SmartID and SmartWallet functionality into an existing site relatively easily:

Most are fairly self-explanatory, and correspond to the core smartcard functions described in 9.1 Smartcard Feature Set.

Possibilities for fieldName in getField(..) and setField(..) are "username", "password", "forename", "surname", "streetaddress", "town", "county", "postcode" and "ccnumber".

Within setSecurity(..), the flags are as defined in 8.1.1 Smartcard PIN requests (true=1 and false=0). getSecurity() returns the current security settings in the same order as specified in setSecurity(), where 0 represents false (off) and 1 represents true (on).

The concept of "conversations" was created in order to prevent the card PIN from having to be repeatedly entered if a page requested several profile fields from the card, and the card was configured always to require the PIN. A block of card instructions on a single page may be surrounded by beginConversation() and endConversation(), during which time if the card requests the PIN, the applet will cache it and automatically return it to the card when required.

6.2.2 Netscape Navigator and Internet Explorer Security Models

Differences between the security models of browsers caused problems in the implementation of the applet, as the means for requesting permission to perform "unsafe" features differs in Netscape Navigator and Internet Explorer.

Within Netscape Navigator, additional code was required within the applet that caused an error to be thrown when run in Internet Explorer. Consequently, a slightly different version of the applet had to be created, and then placed in a JAR file, and digitally signed using a Netscape-specific mechanism.

In Internet Explorer, permission was granted by adding the web site to the list of "trusted sites", for which full Java permissions then had to be enabled. Creation of a CAB file which was digitally signed would allow this process to become more automated (presenting a screen to the user allowing him to allow or deny permissions upon download). However, such a mechanism is also proprietary, and insufficient time was available for this to be successfully implemented.

6.2.3 Drivers for Smartcard Readers

Although native OCF drivers have been created for many smartcard readers, it was found that their installation tends to be fairly complicated (involving manually editing configuration scripts), and is disconcerting for many users. PC/SC drivers, however, now appear to be supplied as standard with the vast majority of readers, usually in a form more suited to installation by non-technical users (e.g. by means of an InstallShield "wizard").

Although they cannot be directly controlled within Java, OCF provides a means to access PC/SC drivers. Therefore, despite resulting in the creation of an extra abstraction layer, this configuration was used to permit the simplest means of client installation.

7.1 Choice of Operating System

Three multiple application smartcard operating systems are commonly in use - namely, Sun’s JavaCard, Microsoft’s Windows for Smartcards and Maosco’s MULTOS. The functionality provided by each appears to be fairly similar - the major difference in implementations being the language in which development takes place (Java, Visual Basic and assembly language, respectively).

The decision was made to select MULTOS cards for development, solely because this is the system upon which the Aston University Smart Campus Card is based. Consequently, it should be possible for the applications written for this project to be loaded onto an Aston card should a suitable application load certificate be obtained from the MULTOS CA.

ISO 7816 Part 4 defines a standard means for card-client communication which is supported by MULTOS and the vast majority of smartcard implementations. Communication takes place via a sequence of APDU’s, which are effectively messages or packets of data formatted in a consistent manner.

Command APDU’s (i.e. those sent to the card) consist of a standard four-byte header, optionally followed by a body of arbitrary length containing data, as shown in Figure 7.1 below:

|

Header |

Body |

|||||

|

CLA |

INS |

P1 |

P2 |

Lc |

Data |

Le |

Figure 7.1: ISO 7816-4 Command APDU structure

where the CLA (class) and INS (instruction) bytes identify which operation is being requested of the smartcard; P1 and P2 are parameters specific to the function called; Lc contains the amount (length) of data present in bytes; Le contains the expected length of the response data in bytes.

Response APDU’s consist of an optional data body, followed by a two-byte trailer, as shown in Figure 7.2 below:

|

Body |

Trailer |

||||||

|

Data |

SW1 |

SW2 |

|||||

Figure 7.2: ISO 7816-4 Response APDU structure

where SW1 and SW2 comprise the Status Word, providing information as to the success or failure of the operation (e.g. 90,00 represents successful; 69,82 security status not satisfied).

Consequently, four fundamental types of command exist, as defined by ISO 7816:

Cases 2, 3 and 4 were deemed suitable for use with respect to the personal profile and wallet functions created for this project, e.g. case 2 for retrieving profile information, case 3 for updating profile information, and case 4 for issuing a debit instruction (where the client sends a cryptographic challenge and the value to be debited, and receives the card’s cryptographic response).

Please refer to the accompanying CD-ROM (‘Card’ directory) or Appendix 7 to view commented code for the card applet created.

As described in 2.2 Requirements, the general functionality required of the smartcard was the storage and retrieval of data in the personal profile, and provision of a "wallet" for electronic cash. For more detailed information upon implementation of the latter, refer to 9 Cryptographic Challenge and Response Cycle.

It would have been possible, and perhaps desirable, to implement two independent applets for providing the profile and wallet features. However, to minimise confusion, all functionality was provided within a single applet for the purposes of this project.

The following instruction set was defined and implemented within MAL code. The numbers in parentheses represent length in bytes, and the prefix ‘0x’ indicates a hexadecimal value.

|

INS |

Feature |

Input Data |

Output Data |

|

0x0n |

Return profile information |

ASCII {30} |

|

|

0x1n |

Set profile information |

ASCII {30} |

|

|

0x20 |

Debit wallet |

Crypto challenge {6} Debit value {2} |

Crypto response {8} |

|

0x21 |

Prepare for credit |

Credit value {2} |

Crypto challenge {8} |

|

0x22 |

Attempt credit |

Crypto response {8} |

|

|

0x23 |

Repeat last debit response |

Crypto response {8} |

|

|

0x30 |

Return balance |

Balance {2} |

|

|

0x40 |

Submit PIN |

PIN {2} |

|

|

0x41 |

Set PIN |

New PIN {2} |

|

|

0x42 |

Update security settings |

Settings {4} |

|

|

0x43 |

Return current security settings |

Settings {4} |

|

|

0x44 |

Unblock card |

Unblock code {8} |

Figure 8.1: Implemented smartcard feature set

As an additional measure of security, the applet was designed not to perform "dangerous" operations (such as debits and profile changes) unless the correct PIN is submitted directly beforehand (using instruction 0x40).

In addition, it was made possible for the user to configure the card as to whether and how often (always, once per session, or never) PIN entry is required for retrieving profile information. Options can be specified for "sensitive" data (password and credit card number) and for "general" data (all other fields).

The four bytes sent and received as security settings in instructions 0x42 and 0x43 represent four flags {privateSec, privateOnce, generalSec, generalOnce}. privateSec indicates whether the card should request PIN entry when retrieving private information, and privateOnce how often this should occur (1 = once per session, 0 = every request). The setting of the latter is irrelevant if privateSec is set false. Similarly, generalSec and generalOnce specify whether and how often the PIN should be requested for the retrieval of general data.

Coding was carried out using a text editor, and Hitachi’s Multos Development Tools used to compile, debug and load the MAL code onto a smartcard.

Very basic functionality was implemented in the early stages of development, with extra features being added once testing proved that those already in existence worked as intended. Extensive use was made of the "MSDT" card simulator to insert breakpoints into code, then transmit particular APDU’s and step through each line of the applet. The system permitted the values of chosen variables to be observed ("watched") whilst stepping through the code, and showed the contents of registers, the stack and the transaction shadow data area - all of which proved invaluable in identifying errors within the code.

To permit testing of the applet upon the smartcard itself, the Terminal Simulator was used to upload the applet (by selection of a suitable load certificate, designed for the development cards), transmit APDU’s and view the card response.

9 Cryptographic Challenge and Response Cycle

Previous design decisions dictated that the only record of the value stored within a user’s wallet was to be on the smartcard itself (see 2.2.1 Electronic cash requirements). Consequently, a system needed to be created whereby:

Furthermore, communication between server and card had to occur via an insecure, untrusted network/client terminal, open to eavesdropping and modification of the data being transferred.

The only means by which the requirements previously detailed could be met appeared, therefore, to be by means of cryptography and the storage of keys on both the server and the smartcard (see 3.5 Encrypted Communication).

The fact that code run on the smartcard can be trusted (see 2.1.1 Applicability of smartcard technology) means that the card can be relied upon to assess whether a credit instruction originated from an authorised source before increasing the balance. Additionally, the card applet can be created such that a particular response (verifiable by the server, and incalculable except using the private key on the card) is generated to indicate that a debit instruction was successful (subject to user authorisation by entry of a PIN).

The fact that, for this project, the card issuer was the same entity as the site which authorised transactions, meant that it was acceptable to use symmetric cryptography (i.e. make use of one private key only, stored on both the server and the card). Consequently, the security of the system would be broken if the private key was ever divulged to a third party. In a release system, the use of asymmetric cryptography or simply a different private key for each card (as in GSM SIM cards) would reduce the potential for such catastrophic destruction of the system’s security!

The procedure to debit the card involves the generation of a challenge by the server, which is transmitted to the client together with the value to be debited. The card then attempts to decrease its balance by the amount specified and - if successful - digitally signs the (challenge,value) data using its private key. The response thus generated can then be returned to the server which, using the same private key as that present on the card, can assess whether the correct response has been returned and thus whether the debit instruction was carried out.

Figure 9.1: Debit communication sequence

The algorithms typically used to perform digital signatures are DES or 3-DES. However, neither was not available on the development card provided; consequently, the function performed was simply an exclusive-or of the 64-bit private key with a concatenation of the 48-bit challenge and the 16-bit debit value. Clearly, such a function is in no way suitable for digital signatures, as it is easily reversible, allowing the private key to be calculated. If implemented on a release card, the values would instead be passed to the digital signature algorithm provided; and the same function used on the server.

Each challenge generated by the server needs to be unique (a nonce), so that the correct response can never be obtained by reference to historic data. For the purposes of this project, use of a 48-bit random number with over 280 billion possible values, is regarded as being sufficient. Deployment in the real world may require the use of longer numbers and a different means for calculating the nonce, in order to provide higher levels of security, and reduce the possibility of brute-force attacks from succeeding.

For topping up the card, a similar strategy is used to that employed within the debit procedure. However, in this case the challenge is generated by the card, and thus an additional stage is required for the challenge to be requested, as shown:

Figure 9.2: Credit communication sequence

‘value’ is set to zero after completion of the top-up to prevent replay of the reponse causing multiple credits.

9.5 Tolerance to Network Failures

In the event of a network failure, the situation may arise where value is successfully debited from the card, and the response is generated but never received by the server. Consequently, the card applet was coded such that the response, once generated, is stored in non-volatile memory; and a command added to the instruction set which causes the card to repeat its last response. Hence, this facility could be used repeatedly to re-attempt transmission of the response over the network until successful.

Similarly, in the event of a network failure preventing a response from reaching the card in the final credit stage, the server needs to be able to re-transmit this as many times as necessary (i.e. take responsibility for making a record of the last response calculated for each user).

9.6 Tolerance to System Interruptions

In the same way that transactions were employed to prevent partial completion of database processes on the server (see 3.4.1 Database Transactions), cards transactions have been used to encompass the critical actions shown in Figures 9.1 and 9.2. Consequently, if power to the card was cut (e.g. by removing (tearing) the card) between critical operations, any changes made would be rolled back when the card was next powered up - hence in the case of debits, subtraction of the balance would be undone if a response was not calculated.

The security model of the cryptographic challenge/response cycle appears to be sound, resilient to fraud attempts such as replay attacks. However, there is no check made during the debit procedure that the debit request is being made by an authorised entity - instead, the user is relied upon to ensure that the site/application they are using is trustworthy (perhaps by reference to an SSL certificate). Within a release system, it would be beneficial to reduce the possibility of unauthorised debits by requiring requests to be themselves signed in some manner.

A test site was created indicating the different stages of the debit and credit procedures, and allowing values to be modified to simulate fraud attempts. This is included on the CD-ROM (‘Web/test’ directory) and at the time of writing was available from http://ee-pc43.aston.ac.uk/laceycs/test/debit.html and http://ee-pc43.aston.ac.uk/laceycs/test/credit.html .

The author believes the project to have been successful, in meeting and exceeding the original aims. An E-commerce site has been successfully created, and - in the absence of suitable specifications from Mondex - a secure smartcard payment system has been created from scratch. Additionally, a smartcard personal profile system has been created in response to the request of Hitachi’s Smart Commerce Division.

Several people were asked to test the sites created, and feedback obtained from them was used to refine the user interface. Considerable testing has also been carried out by the author to ensure the stability of the entire system.

A site was created to demonstrate the workings of the credit and debit procedures, permitting modifications to be made to the data passed to the card and server. Attempts to defraud the system (e.g. by decreasing the value passed to a card for a debit attempt, or conducting replay attacks) all failed.

The only direct costs involved with the development of the system were with respect to smartcard hardware and development tools (kindly donated by Hitachi):

1 GIS Smart Mouse smartcard reader £23.50

2 MULTOS 3 Test Cards @ £20 each £40.00

Total: £63.50

Additionally, two PC’s (a server and a workstation) and various operating systems and pieces of software (Windows, Multos Development Tools, Access) were utilised.

The author believes the time spent researching and developing the system to be in excess of four hundred hours. Additionally, around twelve hours were spent in consultation with academic staff and Hitachi representatives; and approximately three hours with support staff.

10.1 Possible Future Development

Should further time have been available, it would have been desirable to address the following issues:

In the longer term, the project could be developed further by:

The successful creation of smartcard-based electronic cash and personal profile systems, and the integration of these into a fully-functioning E-commerce site, suggest that smartcard technology does provide a feasible solution to some of the problems which prevent E-commerce sites from realising their full potential. Specifically, the end-product created for this project provides a portable, secure means for users to store and transfer electronic cash over the Internet, providing the same benefits that real cash has over credit cards with respect to micropayments, anonymity and speed of transaction. Additionally, the system allows users to complete online forms rapidly, and removes the need for sites to retain records of personal data - providing benefits in terms of privacy and removing the need for users to inform numerous sites whenever details change.

Currently, the use of smartcard technology for these purposes is most fundamentally constrained by the low number of card readers in general use. However, the increasing deployment of smartcards in banking, and the inclusion of smartcard facilities in Windows 2000, can only serve to expedite their increase in popularity.

Nevertheless, a number of other issues have been identified which, until resolved, appear likely to limit the utility of smartcard technology with respect to E-commerce.

Considerable difficulties were encountered in accessing the smartcard from within the web browser: the only means discovered being by use of a framework (OCF) which is too complicated to install for the majority of users. Also, differences in the security models of browsers meant that applets had to be developed which were application-specific or required complicated configuration steps to be carried out.

Additionally, the reluctance of Mondex International to provide their specifications to individuals with whom they have no commercial trust agreement, seems to be indicative of the attitudes of the developers of most electronic cash systems, and suggests that strong confidence still does not exist in the security of these systems.

Widespread adoption of smartcard technology for E-commerce will therefore probably not occur until a standard means for web browsers to interface with them has been developed, and until an open standard exists for the storage and transfer of electronic cash, allowing deployment by all.

1

Ragget D et al: HTML 4.0 Specification, revised 1998, W3C2

Ragget D: HTML 3.2 Reference Specification, 1997, W3C3

Wood L et al: Document Object Model (DOM) Level 1 Specification, 1998, W3C4

Lie H, Bos B: Cascading Style Sheets Level 1, 1996, W3CCobley A: The Complete Guide to Java, 1997, Computer Step

Bakken S, PHP User Manual, 1999, PHP Documentation Group

Devargas M: Smart Cards & Memory Cards, 1992, NCC Blackwell

Johnson S: Using Active Server Pages, 1997, Que

Lie H, Bos B: Cascading Style Sheets Level 1, 1996, W3C

Mitchell S, Atkinson J: Active Server Pages 3.0, 2000, SAMS

Ragget D et al: HTML 4.0 Specification, revised 1998, W3C

Ragget D: HTML 3.2 Reference Specification, 1997, W3C

Rankl W, Effing W: Smartcard Handbook, 1997, John Wiley

Reynolds M, Wooldridge A: Using JavaScript, 1996, Que

Tanenbaun A: Computer Networks, 3rd ed, 1996, Prentice Hall

Wood L et al: Document Object Model (DOM) Level 1 Specification, 1998, W3C

Apache 1.3 User’s Guide, 2000, Apache Group

Client-Side JavaScript Guide v1.3, 1999, Netscape Communications Corp.

Client-Side JavaScript Reference v1.3, 1999, Netscape Communications Corp.

ECMA Standard 262, ECMAScript Language Specification, 1997, ECMA

Java 2 SDK Standard Edition Documentation version 1.2.2, 1999, Sun Microsystems Inc.

Multos 4.0 Development Tools Documentation, 1999, Hitachi

Multos Developers Reference Manual v1.30, 1999, Maosco

Multos Developers Guide v1.20, 1999, Maosco

Appendix 2: Public Explanatory Material

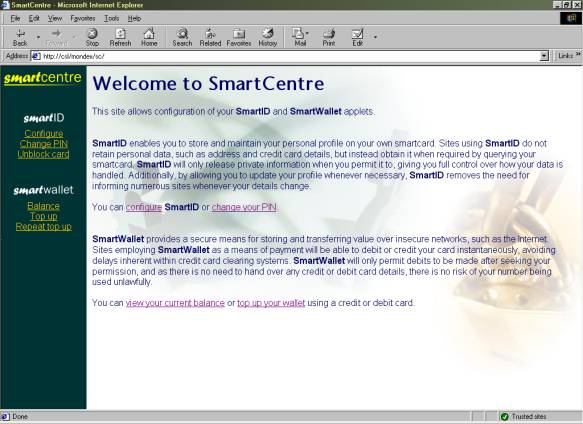

Appendix 2.1: Introduction to SmartID and SmartWallet

This site allows configuration of your SmartID and SmartWallet applets.

SmartID

enables you to store and maintain your personal profile on your own smartcard. Sites using SmartID do not retain personal data, such as address and credit card details, but instead obtain it when required by querying your smartcard. SmartID will only release private information when you permit it to, giving you full control over how your data is handled. Additionally, by allowing you to update your profile whenever necessary, SmartID removes the need for informing numerous sites whenever your details change.You can configure SmartID or change your PIN.

SmartWallet

provides a secure means for storing and transferring value over insecure networks, such as the Internet. Sites employing SmartWallet as a means of payment will be able to debit or credit your card instantaneously, avoiding delays inherent within credit card clearing systems. SmartWallet will only permit debits to be made after seeking your permission, and as there is no need to hand over any credit or debit card details, there is no risk of your number being used unlawfully.You can view your current balance or top up your wallet using a credit or debit card.

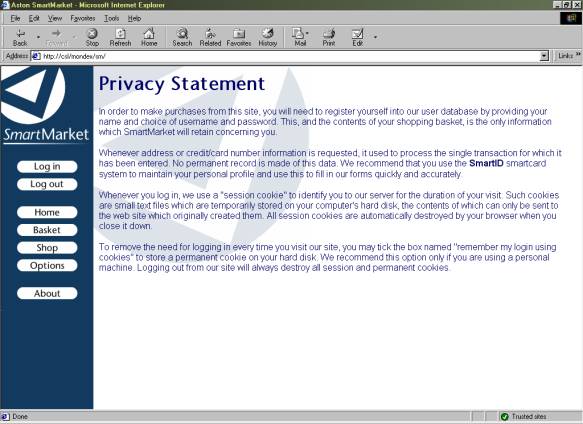

Appendix 2.2: Privacy Statement for SmartMarket

In order to make purchases from this site, you will need to register yourself into our user database by providing your name and choice of username and password. This, and the contents of your shopping basket, is the only information which SmartMarket will retain concerning you.

Whenever address or credit/card number information is requested, it used to process the single transaction for which it has been entered. No permanent record is made of this data. We recommend that you use the SmartID smartcard system to maintain your personal profile and use this to fill in our forms quickly and accurately.

Whenever you log in, we use a "session cookie" to identify you to our server for the duration of your visit. Such cookies are small text files which are temporarily stored on your computer's hard disk, the contents of which can only be sent to the web site which originally created them. All session cookies are automatically destroyed by your browser when you close it down.

To remove the need for logging in every time you visit our site, you may tick the box named "remember my login using cookies" to store a permanent cookie on your hard disk. We recommend this option only if you are using a personal machine. Logging out from our site will always destroy all session and permanent cookies.

Appendix 3: Server Installation Instructions

These instructions are specific Microsoft Windows NT 4 Server, with the Java Virtual Machine, Internet Information Server 3 (with ASP support), and Access ODBC drivers installed. Deployment on other platforms is untested.

Appendix 3.1: Implementing SSL

SSL is not required for the successful implementation of this system. The following procedure can, however, be used to implement it if required. Microsoft Certificate Server will need to be installed before proceeding.

Appendix 3.1.1 Generation of Server Certificate

Once this procedure has been carried out, access to the web site will be available only via SSL (requiring https:// as the prefix to its URL).

Appendix 4: Client Installation Instructions

These instructions are specific to Microsoft Windows 98 with Internet Explorer 5.0 and/or Netscape Navigator 4.7. Deployment on other platforms is untested.

Appendix 4.1: Drivers for Smartcard Reader